The client

Health insurance company that in 2011 had one of the largest reimbursement portfolios in the country. Nearly 40,000 insured persons had Mixed Health Care and Expense Reimbursement coverage, a figure that reached 100,000 five years later.

Up to 100,000 invoices were received annually for which reimbursement was requested and which were accompanied by 500,000 additional documents justifying the service.

The challenge

The software available to support this activity had significant limitations. All documentation had to be scanned when it was received, in addition to transcribing the application data and all invoices into the system.

As a result, many processors were required and there were problems in managing payments in a timely manner. It was also difficult to cope with the increased workload at certain times of the year, which meant that the staff had to be reinforced. On the other hand, in order to speed up the processing certain data which, although not necessary to process the refund, was not recorded, but was of value in analyzing many aspects of the business. Finally, all communication with the policyholder was manual, which limited the company’s fluid and proactive dialogue.

A solution was needed that digitized the entire process. The registration of the data should be the responsibility of the insured and the processing of the payment and communication with the customer should be automated. The aim was to dispense with physical documentation and collect as much data as possible to improve claims, control fraud and provide a better service.

The solution

A technological solution was implemented which allowed the recording of the application for reimbursement was made by the insured person online from a private area. In the first phase, original invoices for health services were requested, but the process was soon automated and the insured provided their documents by uploading a photo or digital copy of the documents into the system.

Communications with the insured were automated by means of a logical mechanism linking changes in the status of the application with the sending of notifications to the insured’s e-mail and private area. In this way, messages were personalised according to the characteristics of the customer and the condition of his request.

The solution also automated the handling process. The result of the refund was displayed, whether it should be paid or not and with what limit, based on complex business rules that were inserted into the system itself.

The outcome

In 2012, this was the first insurance company to completely digitalize reimbursement processing, achieving that 90 percent of policyholders adopted the digital application channel during the first year of its implementation. The traditional channel of manual handling was abandoned by the customers as digital processing was much easier and faster.

As the policy portfolio grew, the demand for reimbursements increased, but it was not necessary to increase the number of claims handlers available, and it was possible to reduce them to other functions in the company. In fact, the increase in activity that took place during the following years would have required an exponential increase in human resources if all operations had not been digitalized and automated.

Customer satisfaction increased to 8.9 points in this area, one point above the rest of the aspects evaluated in insurance. Processing times were reduced to less than four working days, well ahead of any other insurer at the time. Four people were enough to register, process, make the payment decision and pay 500 daily invoices – more than 1000 acts –. This meant a 42% reduction in resources dedicated to this function despite a nearly 300% increase in activity.

Increased

activity by 300%

300%

Reduction of

dedicated resources by 42%

42%

Together we can build a better future

Technology as a tool for progress

Contact us

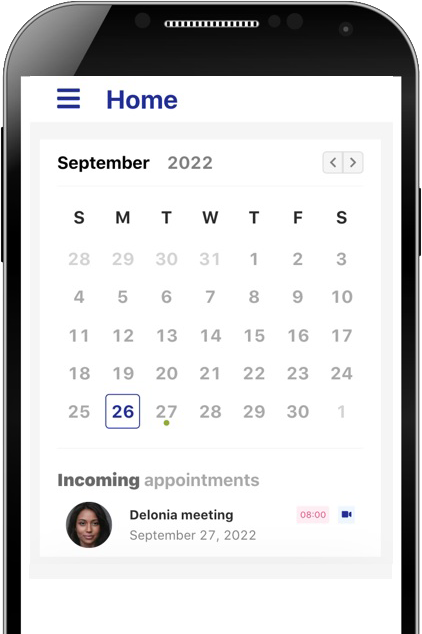

Schedule an appointment online

So that we can call you, make a video consultation or visit you at the time and through the channel you indicate.

© Delonia Software 2024

Services

Solutions

About Delonia

Follow us on LinkedIn

Co-financed