At Delonia, we specialise in developing support systems for insurers and reinsurers, with a specific focus on health insurance technology. That is why we were very interested in the report The State of Life 2024, produced by SCOR and referenced by Aseguranza.

The five main challenges identified by SCOR are not new to the sector, but what were once merely theoretical concerns are now becoming real and tangible risks that the market must address. Moreover, and perhaps more importantly, these risks are deeply interconnected, creating a clear network of threats to the fundamentals of life and health insurance.

1. Climate as an uncertain risk

We are not just talking about floods or hurricanes that increase compensation payments, but rather a cross-cutting risk that affects everything else:

- Health risks: more intense heat waves, new epidemics caused by species displacement, and even water and food shortages.

- Geopolitical tensions: the struggle for water resources and fertile land is becoming a trigger for conflict.

- Economic uncertainty: if agriculture suffers and the supply chain is affected, increased economic instability is inevitable.

SCOR is clear: climate change is the ‘glue’ that binds almost all other risks together. The consequences are difficult to quantify, but they should not be ignored.

2. The demographic time bomb

Increased life expectancy is one of humanity’s greatest victories, but also a monumental challenge for insurance companies. The ageing population is completely redefining healthcare needs and social behaviours.

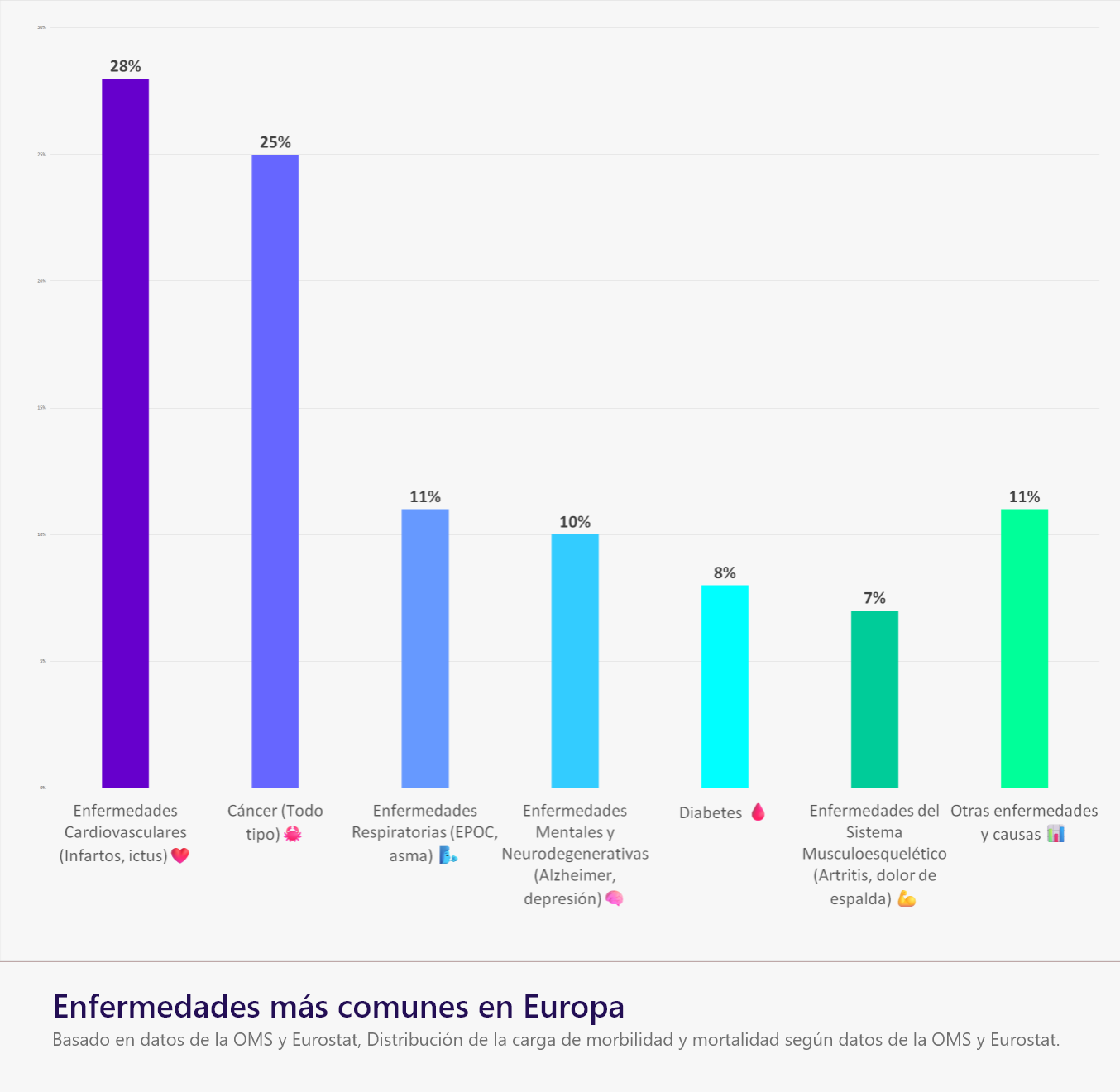

SCOR experts point out that, while the main causes of mortality such as heart disease will continue to dominate, there will be a massive increase in non-communicable diseases linked to ageing, such as Alzheimer’s, diabetes and chronic kidney disease. This requires the sector to adapt with services and products that not only cover death, but also offer solutions for a longer life, albeit with greater care needs.

Furthermore, the long-term effects of persistent COVID-19 are unknown and could have a significant impact on morbidity and disability.

3. Unhealthy lifestyle habits

This point is directly linked to the previous one. As people live longer, they seek to maintain their independence. This creates a market of opportunities for home care services, nursing homes and personalised care. The insurance sector, in general, has not fully exploited this ‘ageing economy’, and it is a window of opportunity that is opening wide.

However, there is another side to the coin: modern risk behaviours. From the ‘obesity pandemic’ and sleep deprivation to the opioid crisis in the US (79,358 deaths in 2023), all these factors have the potential to reduce life expectancy in specific segments of the population and increase healthcare costs. The SCOR report also highlights the worrying issue of antibiotic resistance, a threat that could jeopardise common medical procedures such as surgery.

4. Pandemics are no longer a thing of the past

Before COVID-19, pandemics were seen as a theoretical and distant risk. Today, we know that they are a real threat and can strike at any time. Globalisation and the effects of climate change increase the likelihood of new infectious diseases emerging.

The COVID-19 experience has taught us a valuable lesson: preparedness is key. We now know how to respond and mitigate the effects of a large-scale health crisis. According to SCOR, although the risk is greater, it is also more ‘manageable’ if we act with foresight.

5. Geopolitical uncertainty

The world is fragmenting. Wars, trade tensions and rivalry between superpowers are shaping a new global order. Destabilisation has direct consequences for the economy: it can fuel inflation, generate unemployment and exacerbate social inequalities.

For the insurance sector, this uncertainty not only affects profitability, but also creates an environment of volatility that requires much more sophisticated risk management.

In summary, life and health insurance can no longer operate under the rules of the last century. The SCOR report is a call to action for the sector. Risks are interconnected, and to meet today’s challenges, companies must evolve and adopt approaches that take into account the complexity of these new scenarios.