1 What is the service portfolio?

One of the common problems in the health insurance industry, and a constant source of conflict between the client and the insurer, is determining exactly what is covered and what is not covered in a policy. All companies have their own portfolio of services and normally, the contract lists the coverage in a general way, with more or less detailed descriptions of the guaranteed services. In theory, each guarantee or coverage has an associated medical nomenclature, with the services or acts of medical practice included. Ideally, these services should be related or linked to the policy coverage in a clear way but, however, this relationship between the detail of the services and the contracted coverage is generally unknown to the insured.

Until now, to think of attaching to the insurance contract, already extensive and dense for the insured, the list of the thousands of medical acts or services included in the coverage would not be very pragmatic, as well as useless, due to the changing dynamics of these services. Changes in service portfolios are common, for example, when medical technology is updated or contract coverage is modified. Therefore, this practice would be crazy.

The portfolio of services of a health insurance policy is the list of services, procedures and techniques that the insurance company uses to make the health benefit of such insurance effective. It is understood that it is Digital, when it is available to be managed and accessible by web and/or app via web services.

2 Digital Portfolio of Services

This problem can be approached in a completely new way when we approach it from a digital perspective. The availability of information on-line, in terms of form and timing, radically changes information management. For this reason, it is now possible to provide the exact list of medical acts that make up the coverage, in a practical and convenient way, providing greater transparency to the actual content of insurance contracts.We will call this list of acts/services the Digital Portfolio of Services (CDS).

In this context, each of the services of this Digital Portfolio of Services may have specified parameters that respond to different business and product rules, depending on the aspects to be configured, such as those indicated below. The operational, customization and automation possibilities thus opened up are very broad:

- Service limits/franchise

- Service access rule

- Cost of service if not covered

- Prerequisites

- And all those elements of coverage and operations that you wish to associate with it

The Digital Portfolio of Services makes it possible to establish different operational and functional models for the same service.

Thus, it is possible to establish different operational and functional models for the same service, depending on the service portfolio of the coverage in which it is included. For example, the same service may be covered under one policy, but only as access to the service in another, or even under an excess.

The companies have specifically agreed on the services to be provided by each of the professionals or centers that make up their medical staff (this is what we call the Provider’s Portfolio of Services). This agreement includes the description of the services, their groupings (forfait), conditions and prices (scale). The company’s global service portfolio will be the set of portfolios agreed with its suppliers and available to the customer. This is what makes up the general nomenclature that includes all the company’s services.

In the above context, the next step will be to associate to the product’s health coverage the services of the general nomenclature that correspond to the definition and risks guaranteed by the product.

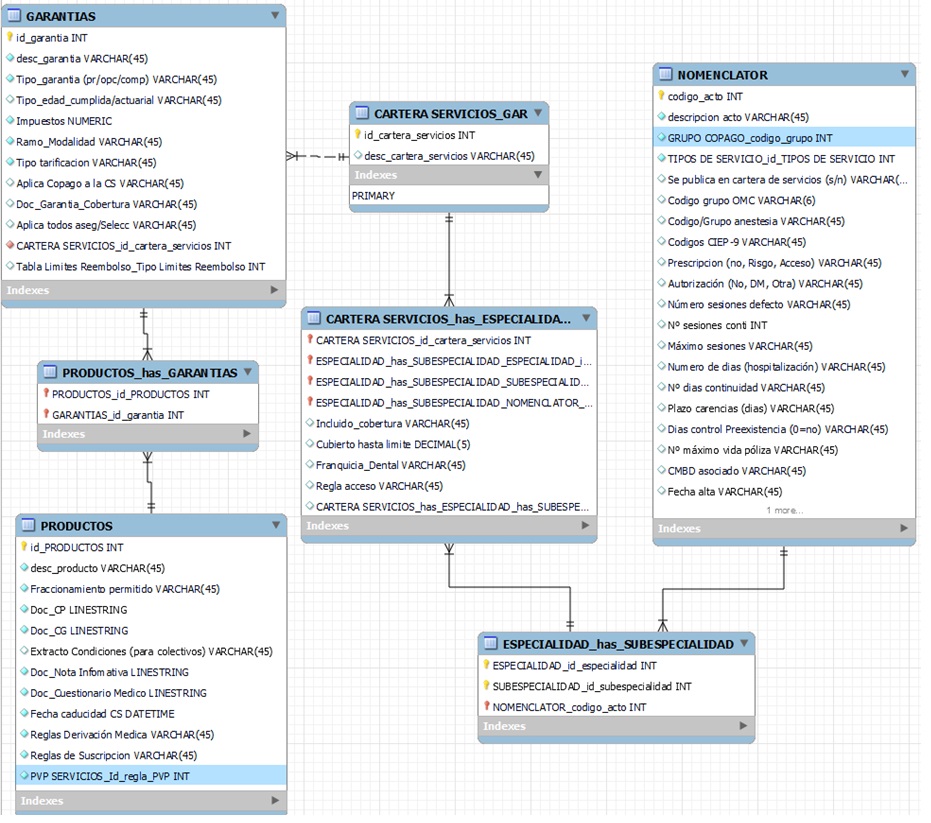

The figure shows a relational data model (RDM) as an example of a possible implementation of a service portfolio. In this case, the coverage is called a guarantee, but for practical purposes it has the same meaning we are giving it.

Model representing the product/warranty/CDS/nomenclature relationship.

3 Advantages of the Digital Portfolio of Services

The structure described above opens up many possibilities for the management of the insurance company and its relationship with customers and suppliers:

1. It provides the customer with a completely different relationship with their insurance, and a much more transparent and positive experience. Thus, a client can consult from his Private Area whether a specific service is within his coverage, and even receive information on the conditions or limits for access to such service.

2. For the company, it will facilitate the management of the evolution of the nomenclature/portfolio to add, modify or delete services and that everything is properly recorded.

3. The service portfolios associated with coverage also help in the implementation of new products by combining them and, therefore, their service portfolios. To include a coverage is to add its associated portfolio of services. If the healthcare software supports this functionality, it will provide the company with great flexibility in creating and launching commercial offers to customers, reducing time to market.

4. Managing a portfolio of services also improves management with providers, since each one of them will have its own particularized portfolio of services and not a generic one that sometimes contains services that the professional does not perform or that have not been agreed upon with the provider.

5. This model also facilitates the automation of various processes, for example, the authorization of benefits.The current authorization process is still perceived by policyholders as a heavy bureaucratic requirement imposed by the company. In turn, the insurer spends a lot of resources on managing this claims control activity, which generates administrative work that is often ineffective.

6. As we will point out below, with a digital portfolio of services, it is easier to accurately manage the exclusion of benefits.

4 The Digital Portfolio of Services in the management of exclusions

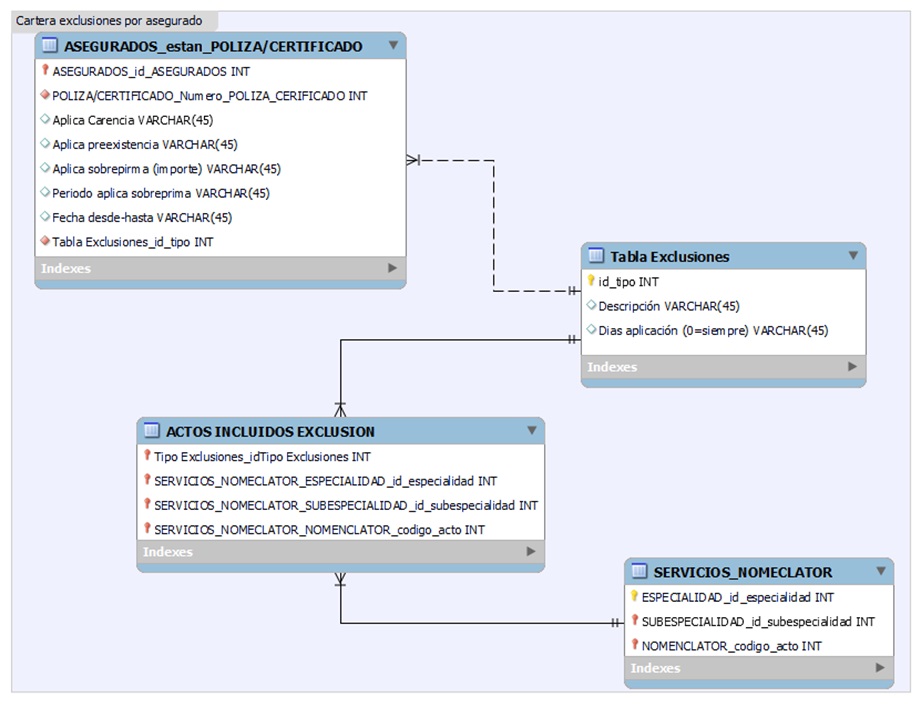

One of the problems in the interpretation of health contracts is the exclusions of coverage derived from the health questionnaire. These exclusions are normally included in the particular conditions (Insurance Contract) by means of generic descriptions that have to be interpreted. This new approach would allow an exclusion to be associated with a portfolio of affected services, i.e., excluded benefits. This relationship would not only facilitate access to information for the insured, but would also help to automate the authorization processes and provide consistency in the assessment of the medical departments, minimizing subjective interpretations.

As we commented in the post on the Health Questionnaire, it is optimal that each declared pathology/procedure is associated with the corresponding excluded services, adapting the system progressively according to the definition and learning phases:

1. Initially, a preliminary association of the excluded portfolio of services associated with a pathology can be made directly elaborated by the Medical Department staff who are already interpreting these exclusions.

2. For a period of time, an intelligent learning system will be maintained, automatic or not, which will modify this portfolio of excluded services, but supervised by the Company’s medical managers. This will be fed with information or cases from the authorization system (we will talk about the Service Authorizing Center in another article). As a service is rejected by the medical department due to an exclusion, this exclusion will complete the definitions of excluded services by pathology that the learning system is incorporating.

3. With time and a sufficient number of cases, the system will already be able to manage authorizations and validations of excluded services and pre-existing conditions autonomously and automatically.

MER model for exclusion management.

In short, the on-line world allows us to handle large amounts of data with a level of detail that paper cannot support. This has as a direct consequence a better service to the client, who perceives that the company informs him or her with greater transparency about the conditions of his or her insurance. On the other hand, a digital portfolio of services facilitates the automation of processes, limiting the interpretation and assessment made by benefit managers, which is necessarily more subjective and less agile.